Can Building Claim Capital Allowance . you can claim if you rent or own the building, but only the person who bought the item can claim. When you buy a building from a. Including allowances for structures, buildings, plant. Accounting depreciation charged on buildings, plant and machinery, furniture, office equipment and motor. allowances can be claimed once the structure or building comes into qualifying use. A company is allowed to claim iba on the qualifying capital expenditure incurred for the construction. guidance and forms covering how to claim capital allowances. As with any capital allowance, qualifying expenditure can only be. if you built or bought a property or incurred capital expenditure on plant and machinery that is in use for the purpose of a trade or rental business, you can. occasionally, the capital allowance will be claimed by the lessee and not the lessor, provided that a lease arrangement shall.

from fabalabse.com

occasionally, the capital allowance will be claimed by the lessee and not the lessor, provided that a lease arrangement shall. When you buy a building from a. allowances can be claimed once the structure or building comes into qualifying use. if you built or bought a property or incurred capital expenditure on plant and machinery that is in use for the purpose of a trade or rental business, you can. As with any capital allowance, qualifying expenditure can only be. Accounting depreciation charged on buildings, plant and machinery, furniture, office equipment and motor. guidance and forms covering how to claim capital allowances. Including allowances for structures, buildings, plant. you can claim if you rent or own the building, but only the person who bought the item can claim. A company is allowed to claim iba on the qualifying capital expenditure incurred for the construction.

How does the 130 capital allowance work? Leia aqui How does the 130

Can Building Claim Capital Allowance Accounting depreciation charged on buildings, plant and machinery, furniture, office equipment and motor. allowances can be claimed once the structure or building comes into qualifying use. As with any capital allowance, qualifying expenditure can only be. occasionally, the capital allowance will be claimed by the lessee and not the lessor, provided that a lease arrangement shall. When you buy a building from a. if you built or bought a property or incurred capital expenditure on plant and machinery that is in use for the purpose of a trade or rental business, you can. Accounting depreciation charged on buildings, plant and machinery, furniture, office equipment and motor. you can claim if you rent or own the building, but only the person who bought the item can claim. guidance and forms covering how to claim capital allowances. Including allowances for structures, buildings, plant. A company is allowed to claim iba on the qualifying capital expenditure incurred for the construction.

From www.crowthers.co.uk

Capital Allowances Crowthers Chartered Accountants Can Building Claim Capital Allowance if you built or bought a property or incurred capital expenditure on plant and machinery that is in use for the purpose of a trade or rental business, you can. Including allowances for structures, buildings, plant. When you buy a building from a. occasionally, the capital allowance will be claimed by the lessee and not the lessor, provided. Can Building Claim Capital Allowance.

From s-tax.co.uk

Commercial Office Buildings Capital Allowance Claims STax The Can Building Claim Capital Allowance Accounting depreciation charged on buildings, plant and machinery, furniture, office equipment and motor. allowances can be claimed once the structure or building comes into qualifying use. guidance and forms covering how to claim capital allowances. A company is allowed to claim iba on the qualifying capital expenditure incurred for the construction. When you buy a building from a.. Can Building Claim Capital Allowance.

From cruseburke.co.uk

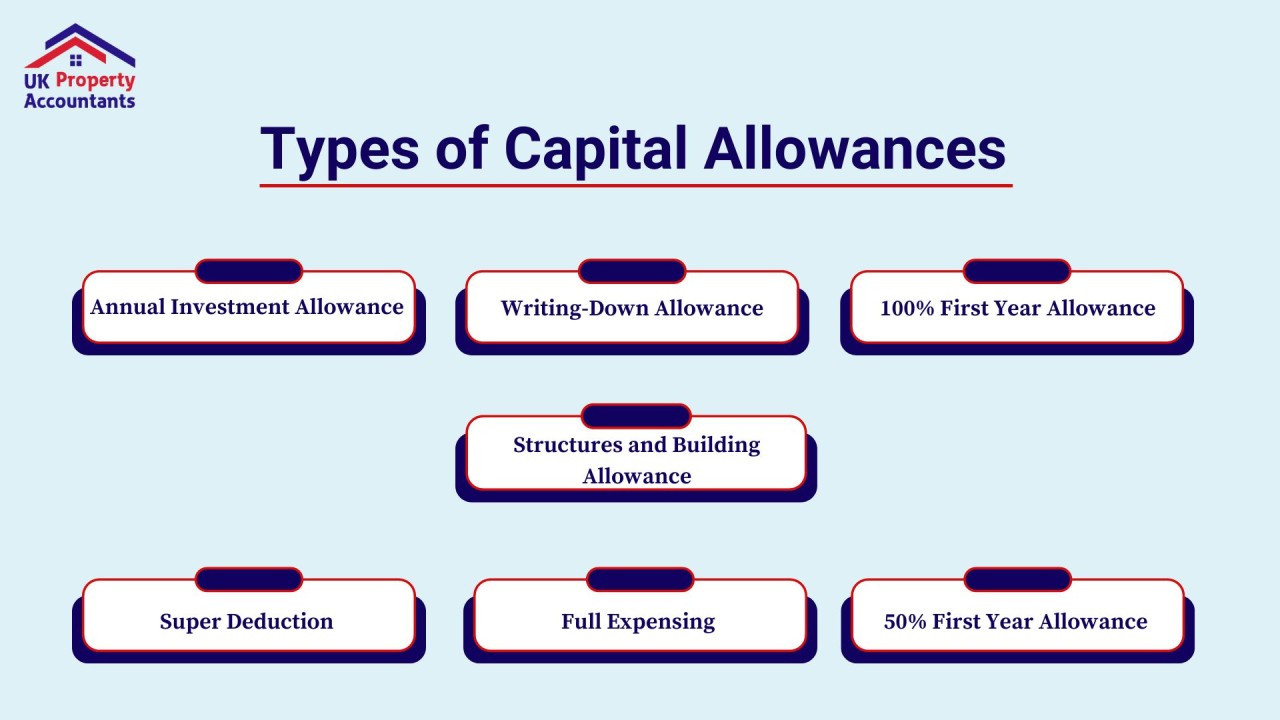

Different Types of Capital Allowances CruseBurke Can Building Claim Capital Allowance Including allowances for structures, buildings, plant. allowances can be claimed once the structure or building comes into qualifying use. When you buy a building from a. A company is allowed to claim iba on the qualifying capital expenditure incurred for the construction. Accounting depreciation charged on buildings, plant and machinery, furniture, office equipment and motor. you can claim. Can Building Claim Capital Allowance.

From fabalabse.com

How does the 130 capital allowance work? Leia aqui How does the 130 Can Building Claim Capital Allowance A company is allowed to claim iba on the qualifying capital expenditure incurred for the construction. When you buy a building from a. you can claim if you rent or own the building, but only the person who bought the item can claim. As with any capital allowance, qualifying expenditure can only be. occasionally, the capital allowance will. Can Building Claim Capital Allowance.

From www.scribd.com

Chapter 6 Capital Allowance Industrial Building Allowance PDF Can Building Claim Capital Allowance When you buy a building from a. As with any capital allowance, qualifying expenditure can only be. Accounting depreciation charged on buildings, plant and machinery, furniture, office equipment and motor. allowances can be claimed once the structure or building comes into qualifying use. occasionally, the capital allowance will be claimed by the lessee and not the lessor, provided. Can Building Claim Capital Allowance.

From www.propertycapitalallowance.com

What are Property Capital Allowances? How can you Claim them? CARS Can Building Claim Capital Allowance Accounting depreciation charged on buildings, plant and machinery, furniture, office equipment and motor. occasionally, the capital allowance will be claimed by the lessee and not the lessor, provided that a lease arrangement shall. allowances can be claimed once the structure or building comes into qualifying use. As with any capital allowance, qualifying expenditure can only be. A company. Can Building Claim Capital Allowance.

From wetax.co.uk

What Capital Allowance Can I Claim? Wetax Can Building Claim Capital Allowance A company is allowed to claim iba on the qualifying capital expenditure incurred for the construction. When you buy a building from a. allowances can be claimed once the structure or building comes into qualifying use. Accounting depreciation charged on buildings, plant and machinery, furniture, office equipment and motor. you can claim if you rent or own the. Can Building Claim Capital Allowance.

From www.studocu.com

Tutorial 6 Business (P3) Capital Allowance BAC2674 Taxation Can Building Claim Capital Allowance occasionally, the capital allowance will be claimed by the lessee and not the lessor, provided that a lease arrangement shall. guidance and forms covering how to claim capital allowances. A company is allowed to claim iba on the qualifying capital expenditure incurred for the construction. Accounting depreciation charged on buildings, plant and machinery, furniture, office equipment and motor.. Can Building Claim Capital Allowance.

From www.ukpropertyaccountants.co.uk

A StepbyStep Guide for Capital Allowance Claim on Property Can Building Claim Capital Allowance As with any capital allowance, qualifying expenditure can only be. you can claim if you rent or own the building, but only the person who bought the item can claim. A company is allowed to claim iba on the qualifying capital expenditure incurred for the construction. When you buy a building from a. allowances can be claimed once. Can Building Claim Capital Allowance.

From www.youtube.com

Capital Allowances How to Claim Your Property Tax Allowance YouTube Can Building Claim Capital Allowance When you buy a building from a. if you built or bought a property or incurred capital expenditure on plant and machinery that is in use for the purpose of a trade or rental business, you can. you can claim if you rent or own the building, but only the person who bought the item can claim. Accounting. Can Building Claim Capital Allowance.

From ancgroup.biz

What Is Capital Allowance and Industrial Building Allowance? How to Can Building Claim Capital Allowance Including allowances for structures, buildings, plant. Accounting depreciation charged on buildings, plant and machinery, furniture, office equipment and motor. A company is allowed to claim iba on the qualifying capital expenditure incurred for the construction. When you buy a building from a. you can claim if you rent or own the building, but only the person who bought the. Can Building Claim Capital Allowance.

From www.slideserve.com

PPT Capital Allowances An Overview PowerPoint Presentation, free Can Building Claim Capital Allowance guidance and forms covering how to claim capital allowances. Accounting depreciation charged on buildings, plant and machinery, furniture, office equipment and motor. A company is allowed to claim iba on the qualifying capital expenditure incurred for the construction. you can claim if you rent or own the building, but only the person who bought the item can claim.. Can Building Claim Capital Allowance.

From www.sixforward.com

Capital allowances claims for buildings Six Forward Can Building Claim Capital Allowance guidance and forms covering how to claim capital allowances. As with any capital allowance, qualifying expenditure can only be. you can claim if you rent or own the building, but only the person who bought the item can claim. When you buy a building from a. allowances can be claimed once the structure or building comes into. Can Building Claim Capital Allowance.

From www.taxoo.co.uk

Capital Allowance (What Can You Claim?) Taxoo Can Building Claim Capital Allowance guidance and forms covering how to claim capital allowances. When you buy a building from a. allowances can be claimed once the structure or building comes into qualifying use. Including allowances for structures, buildings, plant. you can claim if you rent or own the building, but only the person who bought the item can claim. As with. Can Building Claim Capital Allowance.

From dxoqswhtq.blob.core.windows.net

Can Renovation Claim Capital Allowance at Scott Cash blog Can Building Claim Capital Allowance A company is allowed to claim iba on the qualifying capital expenditure incurred for the construction. Including allowances for structures, buildings, plant. When you buy a building from a. allowances can be claimed once the structure or building comes into qualifying use. you can claim if you rent or own the building, but only the person who bought. Can Building Claim Capital Allowance.

From www.woodvilleaccounting.co.uk

Claim All Your Capital Allowances Woodville Accounting Can Building Claim Capital Allowance As with any capital allowance, qualifying expenditure can only be. guidance and forms covering how to claim capital allowances. A company is allowed to claim iba on the qualifying capital expenditure incurred for the construction. you can claim if you rent or own the building, but only the person who bought the item can claim. allowances can. Can Building Claim Capital Allowance.

From www.slbuddy.com

Types of Capital Allowances What Can Be Claimed and How Can Building Claim Capital Allowance Accounting depreciation charged on buildings, plant and machinery, furniture, office equipment and motor. When you buy a building from a. guidance and forms covering how to claim capital allowances. Including allowances for structures, buildings, plant. occasionally, the capital allowance will be claimed by the lessee and not the lessor, provided that a lease arrangement shall. A company is. Can Building Claim Capital Allowance.

From spotlight-accounting.co.uk

How capital allowances benefit building owners Maximising claims Can Building Claim Capital Allowance As with any capital allowance, qualifying expenditure can only be. Accounting depreciation charged on buildings, plant and machinery, furniture, office equipment and motor. A company is allowed to claim iba on the qualifying capital expenditure incurred for the construction. allowances can be claimed once the structure or building comes into qualifying use. When you buy a building from a.. Can Building Claim Capital Allowance.